Following the previous publication about DACH business culture, in this report, we will share customer behaviors. Thanks to centuries-long shared history and the dominance of the German-speaking community, three countries have similar customer behaviours, distribution channels and changing factors.

1. Customer behaviors in general

Firstly, DACH customers generally place a high value on product and service quality.

To some extent, it can be interpreted as value-for-money choice the combination of price and product/ service quality. The quality can be long life cycle of product or environmentally sustainable, humanistic products (to support disabled, social enterprises), and organic products in Germany (Santander Trade, 2024). When shopping, especially for consumer durable goods, consumers often research for features, origin of goods, and similar products besides price check (WTO Center). Whereas, for daily products, consumers are more sensitive to price, they would rather shop online to compare prices among retailers.

Secondly, sustainability factors such as fair trade, organic and animal welfare are more important to consumers in Germany.

Regardless under economic recession effect with low-price product preference (accounting for 42%), sustainability factors have become inevitable trend in the market. 22% interviewee in 2022 report voted to buy products with fair trade certificates while 25% preferred organic products (Maddren, 2022). Swiss, for instance, would rather choose the origin of products (especially fresh and local products), even higher prices than design or brand’s reputation.

Thirdly, DACH consumers are often very selective, conservative and loyal to familiar brands (WTO Center).

If a customer loves any brand, they will stick to their brand and are also willing to share reviews. About 60% of German consumers are willing to buy the same brand several times (Santandertrade, 2024). They like local products or products from European areas with clear origin and quality.

Fourthly, with average internet penetration at 93%, online shopping has become more and more popular.

With the population of 100 million and the total e-commerce value in 2020 about 106 billion euros (Ecommerce Germany News, n.d. & Statista, 2024), DACH has become one of the most attractive but high value markets in the world. Whereas Austria and Switzerland are among the most valuable e-commerce markets (in value). Thanks to e-commerce popularity, consumers are also becoming more open to cross-border goods.

Fifthly, DACH are tech-savvy buyers with sharp research skills and customer service preference.

They normally use digital devices to conduct thorough research such as evaluating pricing, competitors, features, and reviews online before, during or after their physical shopping trip. This shows that digital influences the entire online and offline shopping journey. Physical shopping experience still matters for better purchasing experience and customer services or ROPO (research online purchase offline trend). Badges, testimonials, and quality certificates shared play a significant role in influencing their buying decisions.

Sixthly, security, privacy, and data protection are top concerns.

Three quarters of Germans believe that their personal data is unsafe on the internet (Statista, 2021) as more and more personal information and transactions are stored and accessible online. Any topics related to privacy, data protection, security, for instance health data cause stronger reactions in Germany and its cultural similarities. Consequently, the government and businesses take it seriously to protect cyber security and secure online transactions (Dot magazine, 2017). Also, data protection and privacy are legalised in European countries, including DACH countries, any business has to follow strictly to meet legal requirements and customers’ demand especially.

Lastly, German is the most widely used language for communication in the DACH area.

Outside Germany, 90% of Austrian and 65% Swiss spoke German (Statista, 2019). In Switzerland, fewer than two-thirds of the population speaks German, while 20% speak French, and less than 10% speak Italian. Even though the DACH countries have a high level of education and proficiency in English, citizens prefer to communicate in their local languages or dialects. In 2021 Global Multilingual CX Report (Unbabel) found that 61% of the German consumers believe it is very or extremely important that brands offer an end-to-end customer experience in their native language, from product promotion to website content and customer service.

2. Factors affecting consumer habits

There are reasons for consumer behaviour’s changes including any changes in macro economics factors, demographics. Especially during this period, the global natural disaster covid-19 has shaken the global consumption behaviours and caused the global economics crisis in a different way. Due to its effect towards every aspect of life, we will mention it in each factor.

Initially, mobile commere on the rise.

Covid-2019 played an integral boost towards online shopping and electronic payment as a weekly normal thing. In 2020, sales generated by mobile devices in Germany reached 28.1 billion euros, which accounted for one-third of all e-commerce sales and increased by 14.6% compared to that in 2019 (Ecommerce Germany News).

This trend continued to rise in 2021, with mobile devices accounting for 40% of all e-commerce sales. Among 14 to 29-year-olds, 2 out of 3 made purchases using smartphones or tablets. Grocery, drugstore goods, and pet supplies continue to be popular online products, with a sales increase of 36.4% (Pleuni, 2022).

Next, economic downturn and political instability.

According to a survey by McKinsey in October 2022, consumer behaviour is changing in response to economic downturns and political changes. The negative outlook on Germany’s economic prospects, following the Russia-Ukraine war, clouded customers’ behaviour. This concern is shared among people of all generations and income groups. The significant increase in prices has resulted in:

- higher expenditure on groceries, energy, and other essential items; and

- a switch to private label or entry-level price brands, as well as lower-cost brands

- a change from discounters or supermarkets and reducing their visits to hypermarkets, speciality grocery stores, organic supermarkets, or convenience stores.

- less purchase at organic supermarkets

And then, Gen Z & social media

Unlike older generations, Gen Z (those born during 1997 – 2010) are reported to be less affected by the cost of living crisis due to their transitory state into adulthood (Mintel, 2021). As a third of Gen Z rents out, the majority still live with parents, leading to more budget for discretionary expenses. Consequently, they are more inclined to explore new shopping behaviours compared to older consumers. It explains why they become increasingly powerful in terms of purchasing power and more brands are interested in targeting them.

Like global trends in DACH, Gen Z is blamed for being lazy, unmotivated and disrespectful at work – a generation prioritises work-life balance too early (Mintel, 2021). To some extent it expresses their opinions of a healthy and sustainable lifestyle, between physical and mental health. It requires brands to adjust their approach in the future which pays attention to mind-body connection.

As born and grown up during the internet, AI eras, gen Z are tech savvy and well informed about global issues. Via internet, their behaviour is not only by product quality, price but also brand’s ethics or commitment. 64% of German Gen Z considers living sustainably the only way to ensure the habitability of the planet for future generations. However, their approach can be different from their attitudes (Mintel, 2021) ranging from brands, locations.

3. Shopping methods and distribution channels

Offline distribution channel

Offline distribution channel in Germany

The German retail food market is generally perceived as consolidated, saturated, and highly competitive, characterised by low prices. Germany has the largest grocery retail channel in Europe (Euromonitor, 2022).

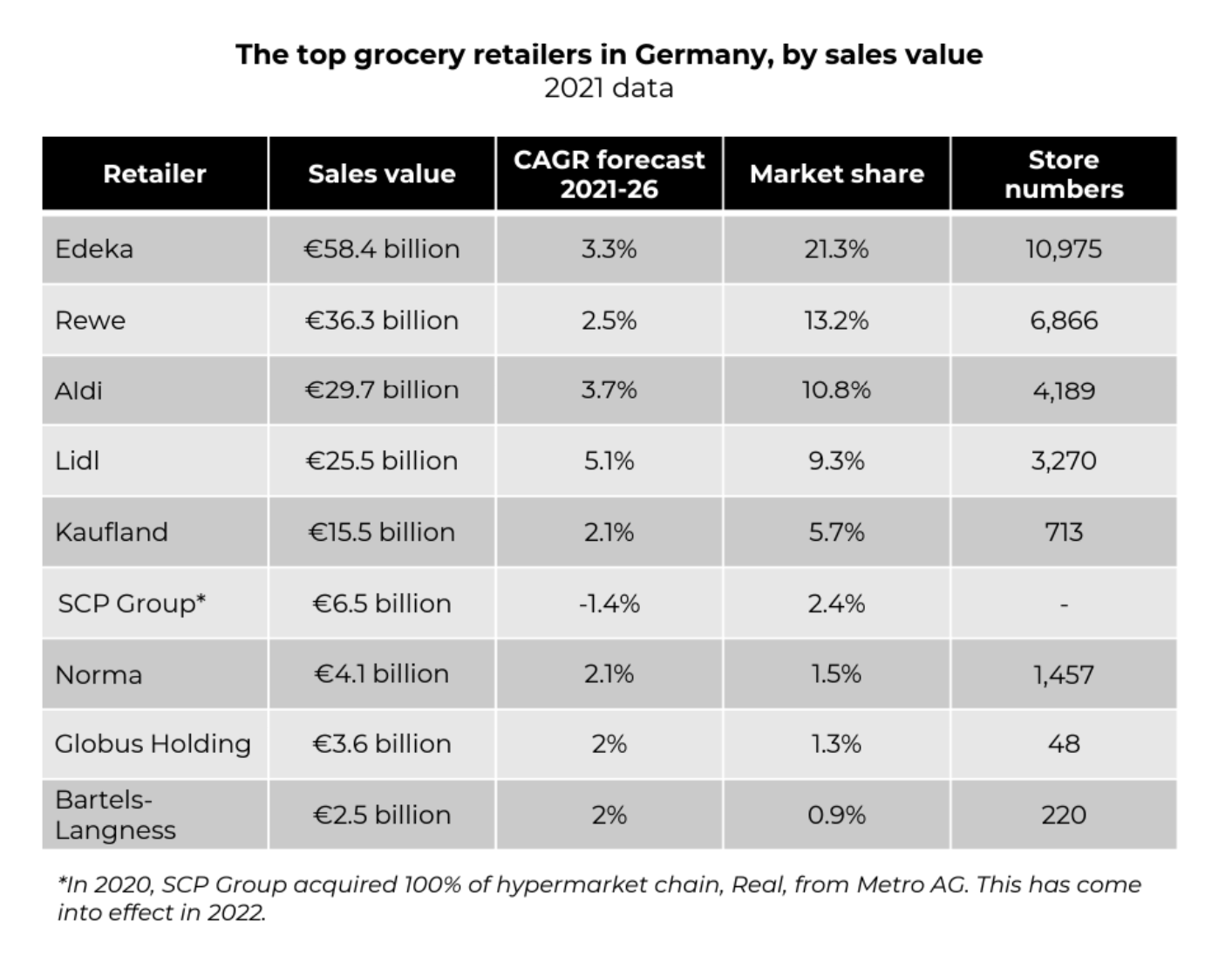

According to Maddren’s report (2022), brick and mortar retailing dominates the market with 83%, valued at 553 billion Euro, but non-store channels, such as digital shops, are expanding their market presence with 17% sales revenue. Discounters like Aldi, Lidl occupy a large portion of grocery retail sales in Germany, followed by supermarkets like Edeka & Rewe. Hypermarkets remain a popular choice for rural and suburban residents due to their convenience and competitive prices.

During the pandemic, supermarkets saw the most significant revenue growth among all retail channels (Lloyds Bank Trade, 2024). The pandemic has led customers to spend more time at home, preferring quick, high-quality grocery shopping in cities and shopping in smaller, more convenient stores. In response to this trend, major retailers are modernising their traditional sites, such as ‘Rewe to Go’ (Rewe Group) and Rewe Group’s acquisition of Lekkerland, a food-on-the-go business, in 2019 (Maddren, 2022). Or they restructured its sourcing model to cut costs or creating “private labels” to compete with discounters.

Offline distribution channel in Austria and Switzerland

In Austria and Switzerland, supermarkets are the primary grocery channels. In Austria, nearly 80% of the retail market is dominated by foreign, particularly German, enterprises. The leading groups include Spar, of Dutch origin with a 36% market share; Billa, part of Rewe Austria of German origin with 33.9%; and Hofer, belonging to Aldi of German origin, with 23.1%. Other players include Penny Markt, MPreis, Lidl, and Unimarkt (Lloydsbank Trade, 2024). In Switzerland, the two largest grocery retailers, Migros and Coop, are of Swiss origin, having the highest level of customer loyalty. Several German discounters, such as Aldi and Lidl, are also active in the market (Lloydsbank Trade, 2024).

E-commerce channels

Regarding e-commerce, big players in German e-commerce include Amazon (US), Otto (Germany), ebay Kleinanzeigen, and Idealo.

The Austrian ecommerce market is dominated by international companies such as Amazon.de (the regional Amazon site based in Germany). The closest competitors are Zalando.at and Mediamarkt.at have also German origin(Ecommerce Germany News, n.d.).

In Switzerland, the major players are ZurRose Group, Digitec.ch, Nespresso, Microspot.ch, and Zalando. Unlike Austrian ecommerce, Swiss consumers focus on the domestic market. Over the last two years, Swiss consumers spent 11 billion CHF on local online purchases, while spending only 2 billion CHF on foreign retailers. Meanwhile, Swiss consumers prefer to shop on foreign websites more than their two neighbours, due to the lack of selection in the domestic market. They often shop for products from France, Germany, and China (Uniteads, n.d.).

by Kate N & Tram Nguyen

Source:

McKinsey & Company. (2022). How current events are shaping German consumer behavior. McKinsey & Company.

Maddren, E. (2022). The grocery retail market in Germany. European Market Research.

Euromonitor International, Grocery Retailers in Germany, 2022